20% Minimum payment

of statement balance

- Lowest payment amount

- Build credit slowly

- 0.5% on each on time payment Cashback

- Moderate interest savings

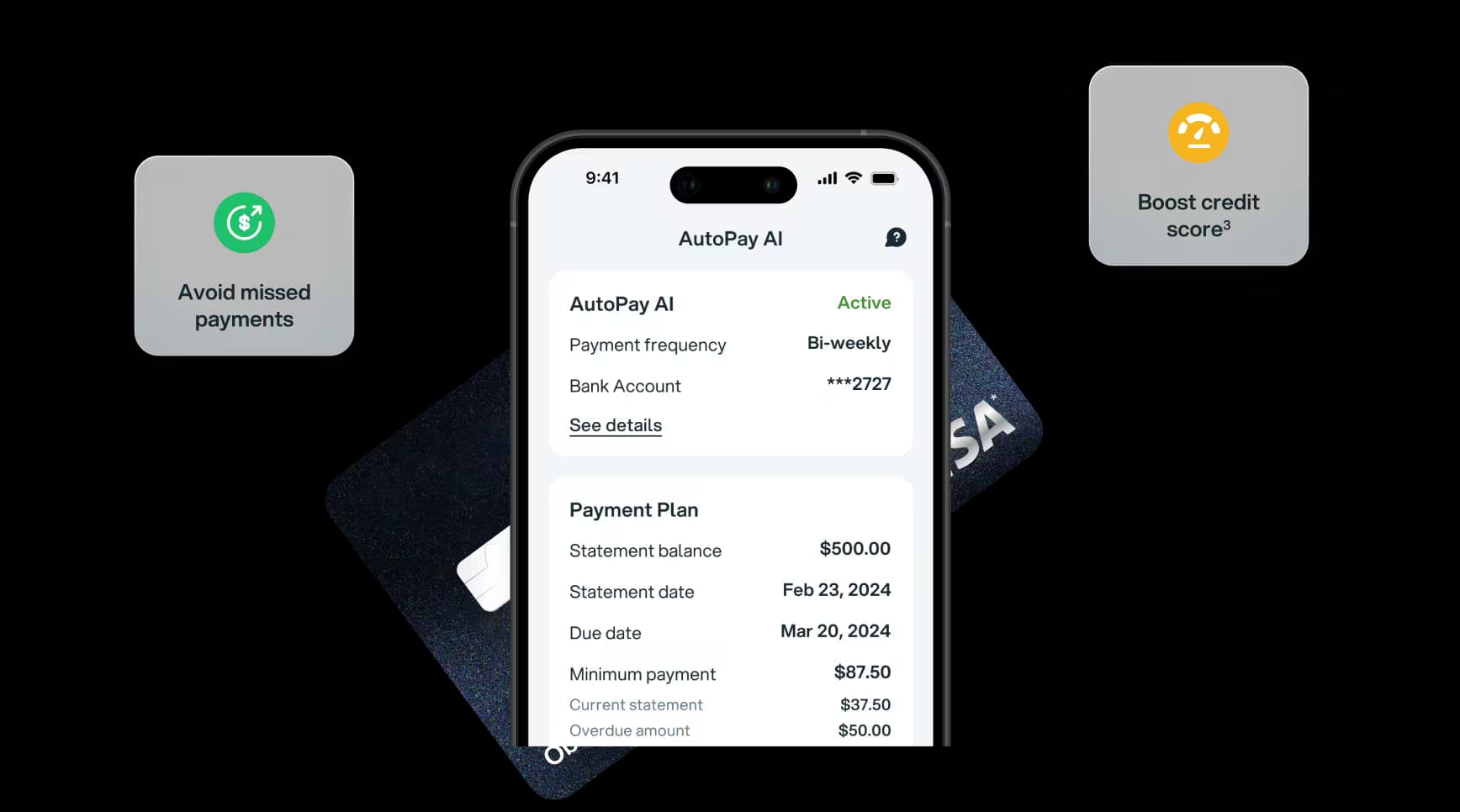

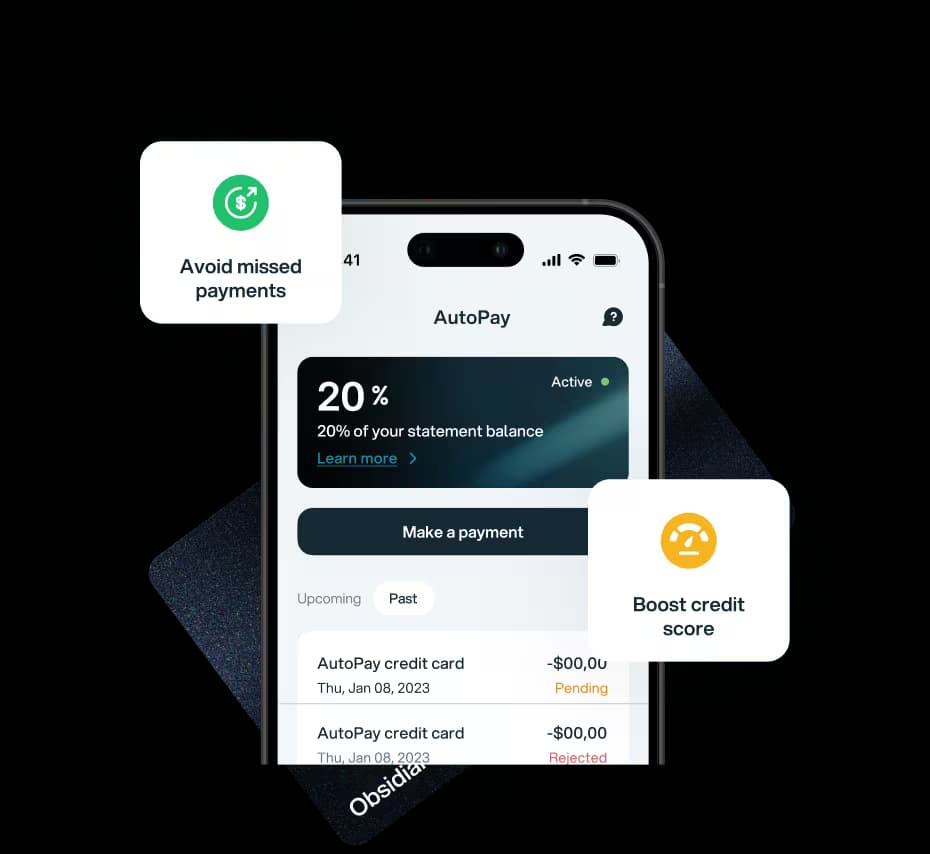

Set it once, and let our AI-powered system handle your payments. AutoPay AI learns your income pattern to create a seamless payment schedule, ensuring you stay on track without the stress.

Apply now

AutoPay AI is designed to help you reach good credit status faster. By analyzing your income and spending habits, it automates payments to ensure you never miss a due date boosting the most critical factor in your credit score.

AutoPay AI is designed to help you reach good credit status faster

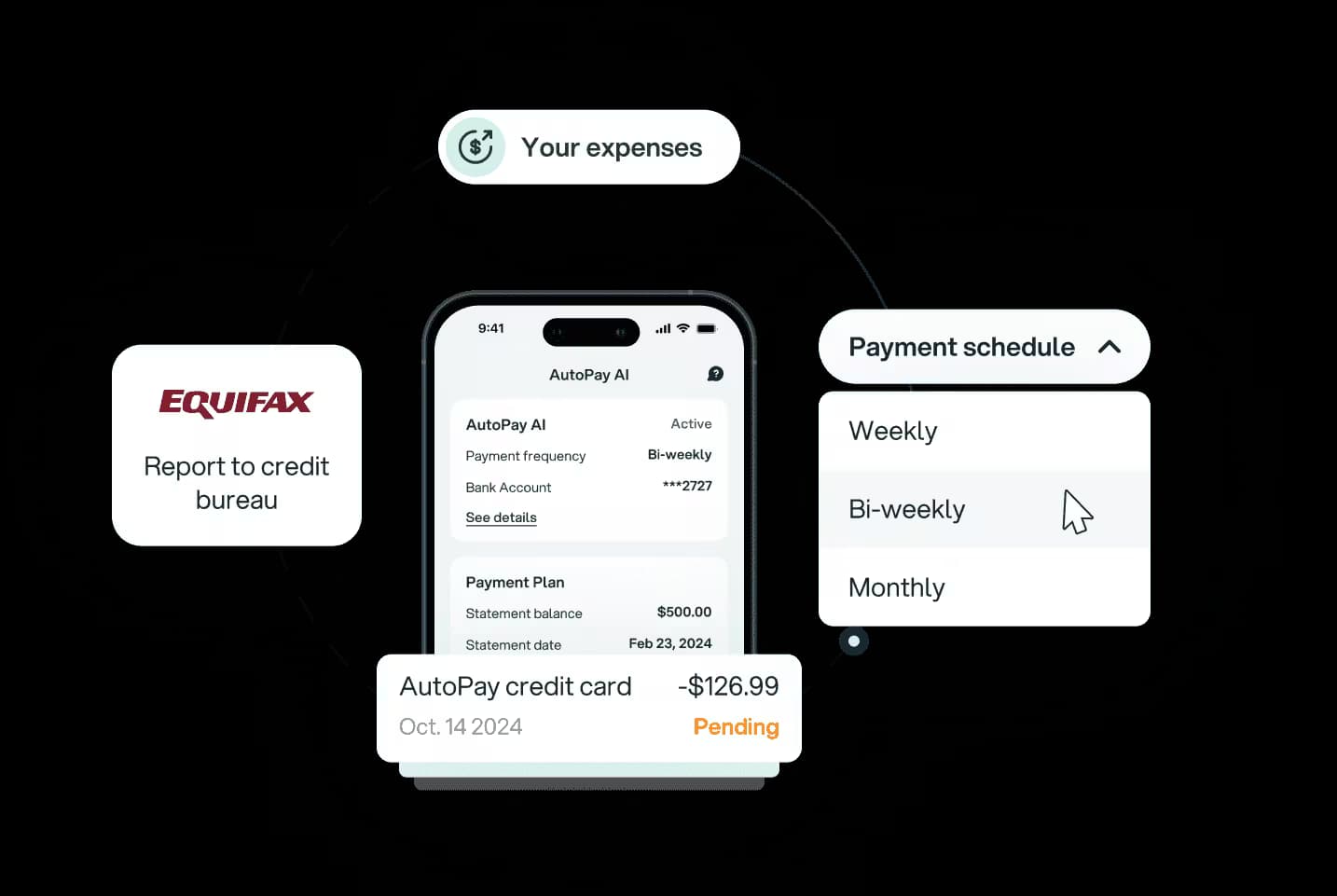

AutoPay AI adapts to your income—weekly, bi-weekly, or monthly—to ensure payments align perfectly with your cash flow.

Get my cardWhile most credit cards only require a minimum payment of 3%, we believe in helping you build stronger financial habits. That's why we've designed payment options that encourage responsible credit management:

of statement balance

of statement balance

of statement balance

Set a percentage or pay in full for max rewards

Securely link & verify instantly

AutoPay AI suggests the best dates, or customize your own

Review, activate, and let Autopay handle the rest

Your financial security is our top priority. AutoPay AI features

Earna Autopay AI vs Traditional payment |  |  |

|---|---|---|

| Schedule setting | Income-based smart scheduling | Fixed dates only |

| Payment options | Multiple flexible options | Usually minimum payment only |

| Income pattern analysis | Advanced AI adaptation | None |

| On-time payment reward | Extra 0.5% cashback | None |

| Full balance payment reward | Extra 0.5% cashback | None |

| Schedule changes | Automatic adjustments | Manual updates required |

| Overdraft protection | Smart scheduling to avoid overdrafts | Basic or none |

| Payment notifications | Comprehensive smart alerts | Basic confirmation |

| Custom scheduling | Full customization available | Limited or none |

"I couldn't be happier with my experience at Earna! Their credit card options are fantastic, and the rewards program has truly enhanced my overall experience. Every time I use my card, I feel valued and appreciated. Thank you, Earna, for making banking so enjoyable!"

Can’t find what you’re looking for?

Contact us here:

[email protected]

1Annual Fees may be paid monthly. Other terms and conditions may apply. Find the complete terms and conditions here.

2 Individual cases may vary. Please contact our Support Team if you experience difficulties.

3 Earna reports your payment activity to one or more credit bureaus to help establish your credit history. Credit scores are calculated using complex models that consider multiple factors. Making on-time payments regularly can help improve credit scores, while missed or late payments can lower them. Individual results may vary.

4 Approval is not guaranteed and terms and conditions apply.

5 Other terms and conditions may apply. Find the complete terms and conditions here.