The most accessible credit card in Canada, designed for you

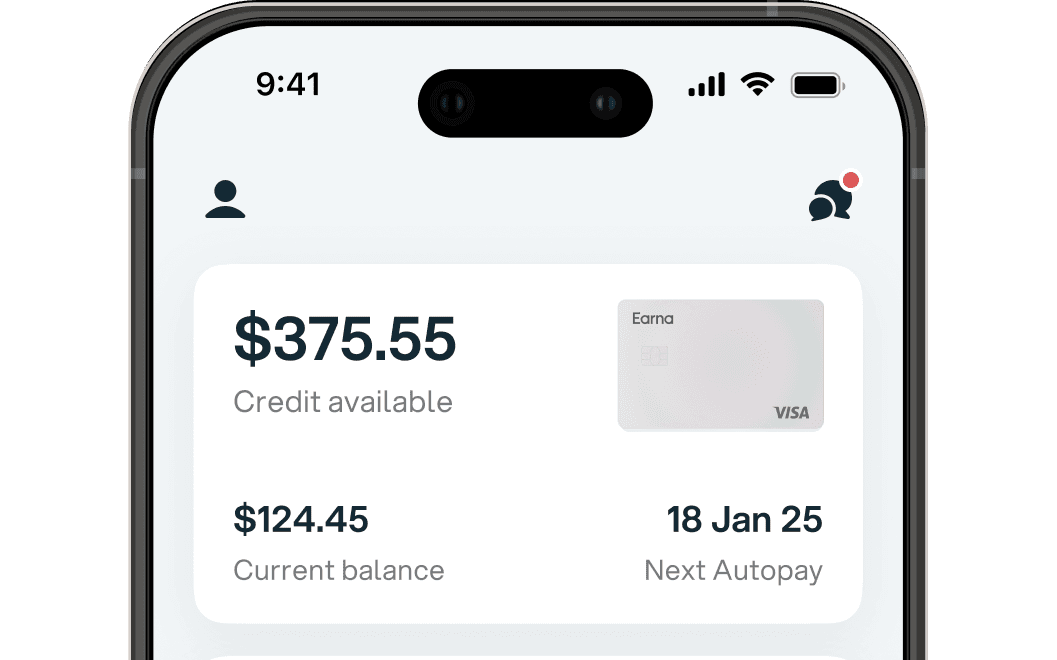

Earna Visa* Card

Accessible credit for all, no deposit, no annual fees1.

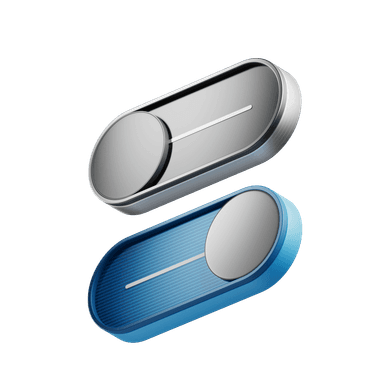

Earna Obsidian Visa* Card

Luxury metal card with higher limits and premium rewards.

No security deposit

Most credit scores accepted

Exclusive Benefits and rewards

Free credit builder³ & credit score

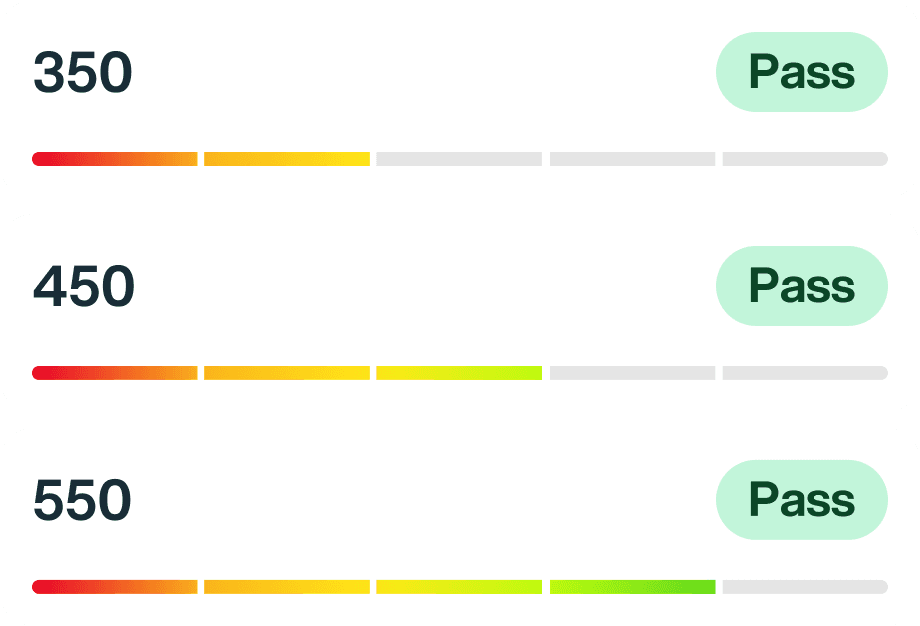

Your credit history won’t hold you back here!

Earna lets you start fresh

A new way to approval⁴

You’re more than a number. We use a unique algorithm that considers various factors to evaluate your true creditworthiness, including individualized assessments based on your financial history.

Scroll

Real unsecured credit card

Earna gives you a real, unsecured credit card. No deposit needed. No waiting period. Just instant access to credit that helps you build your credit score.

Scroll

All income types accepted

We welcome all stable incomes, requiring just a minimum deposit of $800 per month over the last three months.

Scroll

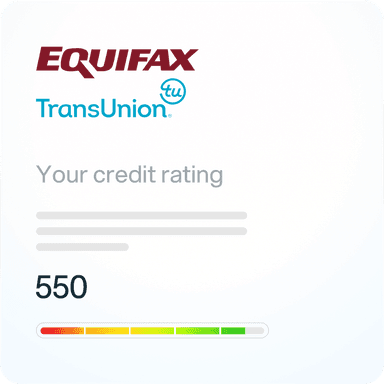

Boost your credit score³

We help you grow your credit by sending your payment history to Equifax every month — at no cost to you.

Milestones

Hit your goals, unlock better benefits. Every Milestone you reach makes your Earna card work harder for you.

$100 credit limit increase

Every 6 months paying on time will unlock a $100 additional credit limit.

Free Credit monitoring

30 days after you signed the contract, Credit health from Equifax is unlocked.

27.99% to 19.99% interest drop⁵

Every 12 months paying on time will decrease your interest by 1% until you reach 19.99%.

Your

Earna Card

works everywhere

Build your credit score with Earna card

Credit score

01230123456789012345678901234567890 pts

Build your credit score with Earna

We report your good habits to Equifax monthly, so your responsible spending builds real credit history. No tricks, no gimmicks – just steady progress you can track right in the app.

Value worth up to

$1,200 a year - all included in

the app

Unlock exclusive perks that more than pay for themselves. Your membership includes credit building tools, partner discounts, and insurance protection – delivering real value that grows with you.

Sport events

15% off

15% offConcerts

15% off

15% offParks & Attractions

15% off

15% offMovie tickets

15% off

15% offSport events

15% off

15% offConcerts

15% off

15% offParks & Attractions

15% off

15% offMovie tickets

15% off

15% offSport events

15% off

15% offConcerts

15% off

15% offParks & Attractions

15% off

15% offMovie tickets

15% off

15% off

Car rental

15% off

15% offFlights

15% off

15% offHotels

15% off

15% offSpa

15% off

15% offCar rental

15% off

15% offFlights

15% off

15% offHotels

15% off

15% offSpa

15% off

15% offCar rental

15% off

15% offFlights

15% off

15% offHotels

15% off

15% offSpa

15% off

15% off

Shopping

15% off

15% offDining & Food

15% off

15% offAutomotive

15% off

15% offHome & Garden

15% off

15% offShopping

15% off

15% offDining & Food

15% off

15% offAutomotive

15% off

15% offHome & Garden

15% off

15% offShopping

15% off

15% offDining & Food

15% off

15% offAutomotive

15% off

15% offHome & Garden

15% off

15% off

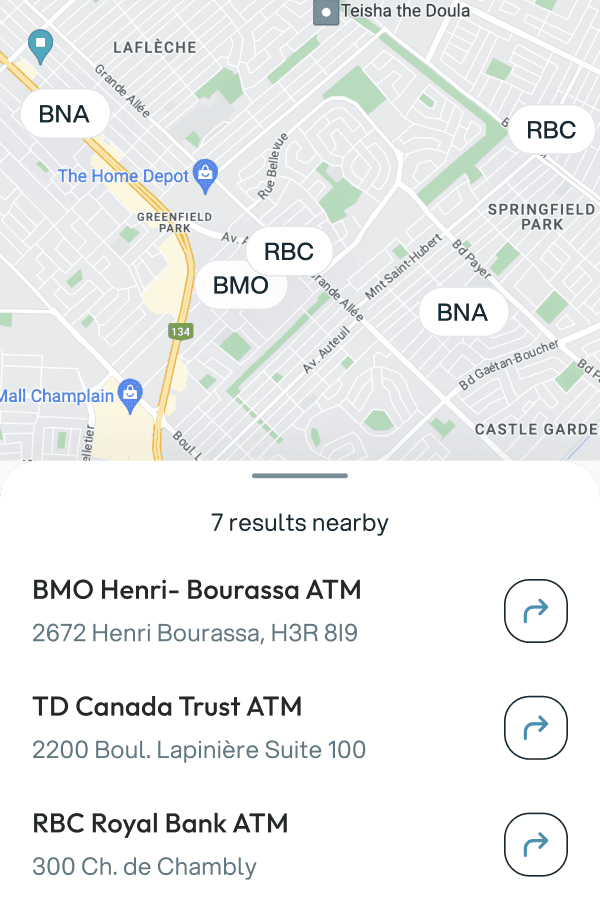

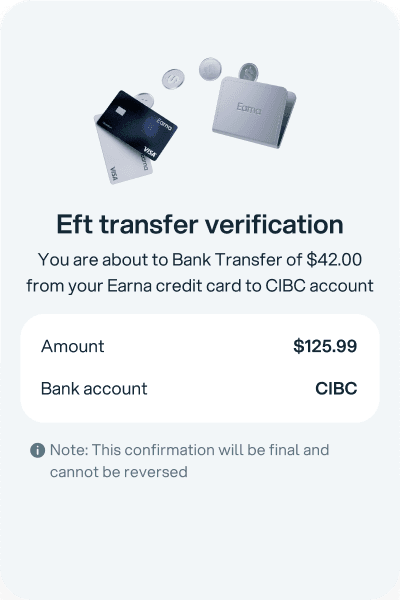

Cash advance — your credit, now in cash

Use your available credit to get cash instantly — whether you need it from an ATM or sent directly via Interac e-Transfer or Bank transfer

Via ATM

Withdraw cash 24/7 at any ATM worldwide.

Interac e-Transfer

Send directly from your credit balance to your chequing account.

Cash in your account in 2 minutes.

Bank transfer

Perfect for planned expenses when you can wait 3-5 days.

Security & Support

Banking security shouldn't keep you up at night. That's why we've built multiple layers of protection into every transaction. Visa Zero Liability means you're never on the hook for fraud. Our AI monitors every swipe 24/7. And when you need help? Real humans are standing by, ready to solve problems. Please note that cardholders are responsible for protecting their PIN.

Online support team

Visa security features

Zero Liability Protection

Lock/unlock card

Transaction monitoring

Online support team

Visa security features

Zero Liability Protection

Lock/unlock card

Transaction monitoring

Online support team

Visa security features

Zero Liability Protection

Lock/unlock card

Transaction monitoring

OUR MISSION

Earna provides fair access to financial tools for every Canadian

We're rewriting the rules of banking with a simple belief: your past shouldn't limit your future. With Earna, access higher credit limit, premium benefits and rewards – because everyone deserves a chance to grow.

Learn more about Earna

Real stories from our members

Get access to your credit in 60 seconds²

- 1

Submit online application

2 minutes to submit

- 2

Get approved⁴

Instant decision in 60 seconds

- 3

Start spending today

Use your digital card right away

Earna Visa* card

Credit limit

$500-$1,500 with instant approval

Cashback¹

Up to 1% total cashback rewards

Discounts

$748+ in savings with discounts

Essential Experience

- High decision rate²

- Online application with instant decision⁴

- No security deposit needed

- Most credit scores are accepted

- Cash advance via Interac - eTransfer, ATM or Bank Transfer

Credit building features

- Real unsecured credit card without deposit

- Reports to Equifax & Transunion monthly for free³

- Automatic Credit limit increase (every 6 months)⁶

- Free credit health by Equifax

- SmartPay Sync™ with Flexible Payment Options

Security & Support

- 24/7 Fraud Protection & Monitoring

- Visa security protection

- Online support 24/7

- Lock/unlock card online

- Transaction monitoring

Requirements

- Must be a Canadian resident in a province where Earna is available

- Must be the age of majority in the province of residence

- Minimum monthly income of $800 (multiple sources of income accepted)

- Must have a Canadian bank account, phone number, address and a source of income

- Most accepted, regardless of credit history⁴

Obsidian Visa* card

Credit limit

$1,500-$3,000 with instant approval

Cashback⁵

Up to 1.5 % total Cashback rewards

Discounts

$1,200+ in savings with discounts

Metal card

Premium 16g metal card with enhanced Rewards

Insurance

Mobile device, transaction and purchase protection included

Premium experience

- Higher credit limits and premium support

- Sleek 16g metal card design

- Insurance coverage for mobile device protection

- Purchase protection & extended warranty

- Cash advance via Interac, eTransfer, ATM or Bank Transfer

Credit building features

- Real unsecured credit card without deposit

- Reports to Equifax & Transunion monthly for free³

- Automatic Credit limit increase (every 6 months)⁶

- Free credit health by Equifax

- SmartPay Sync™ with Flexible Payment Options

Security & Support

- 24/7 Fraud Protection & Monitoring

- Visa security protection

- Online support 24/7

- Lock/unlock card online

- Transaction monitoring

Requirements

- Must be a Canadian resident in a province where Earna is available

- Must be the age of majority in the province of residence

- Minimum monthly income of $800 (multiple sources of income accepted)

- Must have a Canadian bank account, phone number, address and a source of income

- Most accepted, regardless of credit history⁴

Can’t find what you’re looking for?

Contact us here:

[email protected]